This isn't news.

John Felmy, the Chief Economist at the American Petroleum Institute says, "There's no question demand internationally is increasing, and virtually all the major forecasters for the year have been increasing their forecasts for demand worldwide."

This only makes sense. The global economy is coming out of a recession. China just announced that GDP grew 10.9% last quarter. India is expecting to grow GDP at 7.5% in 2010.

Heck, even the UK announced that its longest recession in history was now over and GDP grew in that country at a sedate 0.1%...

And despite what you might hear from Al Gore and U2's leading man Bono, oil consumption will increase over the next ten years.

According to the World Institute for the Analysis of Global Security: "From now to 2020, world oil consumption will rise by about 60%. Transportation will be the fastest growing oil-consuming sector. By 2025, the number of cars will increase to well over 1.25 billion from approximately 700 million today. Global consumption of gasoline could double."

It's simple: More cars are sold in China today than in any other country. India is spending billions to build highways, and India's Tata Motors is now selling a $2,000 car to the masses.

China Loves Oil

The most recent data showed that China's oil demand in November rose 18.7 percent year-over-year — the third straight month of double-digit growth. It is no wonder then that over the past two years, China has been securing long-term contracts to its energy needs. It has used its nearly $2 trillion in foreign reserves to gain access to for foreign gas and oil supplies.

China is selling its suspect dollars to lock in hard assets.

Starting back in 2008 when the price of crude dropped to $35 a barrel, China (through its three top oil companies) started an aggressive campaign to scoop the West. They invested in Iraq, Iran, Kazakhstan, Nigeria, Venezuela, and Argentina, among others.

The Chinese have even invaded North America's backyard. They made inroads against the U.S. supply of Canadian oil sands, as Canada is afraid that new low-carbon fuel standards in the U.S. will restrict the purchase of oil sands oil.

China is also looking to buy leases in the Gulf of Mexico from Devon Energy and announced that they were buying a major holding from the Saudis: a transfer station in the Caribbean.

The Chinese are also beating the Europeans and Russia. The Middle Kingdom has recently built an oil pipeline, the first running east from the oil- and gas-rich nations along the Caspian Sea including Kazakhstan and Turkmenistan. There are reports that certain types of crude from Saudi Arabia can't be bought in Europe anymore... they're all going to China.

And just last month, China Development Bank announced that it was investing $50 billion to buy 6 billion barrels of oil reserves in Nigeria.

Obama Does Nothing...

Given China's aggressive tactics, one might expect the U.S. government might try to counter China's oil grab by securing its own oil future. After all, most of us still remember the oil embargo in the 1970s that drove the economy into a decade of stagnant growth and high inflation...

But you would expect wrong.

From a recent report from the Institute for Energy Research:

On February 4, 2009, Interior Secretary Salazar rescinded 77 oil and gas leases in Utah that could cost American taxpayers millions in lost lease bids, production royalties, new jobs, and the energy needed to offset rising imports of oil and gas.

On February 10, Secretary Salazar delayed for 6 months the development of the new 5-year leasing program for offshore drilling that would have set the framework for accessing newly available areas.

On February 25, Secretary Salazar canceled a new round of commercial-scale oil shale research, demonstration, and development leases in Colorado, Wyoming, and Utah.

On February 26, President Obama introduced a budget that contains page after page of taxes on oil and gas totaling more than $31 billion that will reduce our domestic energy production.

On March 30, President Obama signed the Omnibus Public Lands Management Act into law, prohibiting energy production on over 3 million acres of federal land.

After rescinding 77 Utah oil and gas leases in February, Salazar announced on October 8 that he would lease 17 of them.

On October 20, after canceling a new round of commercial-scale oil shale research, demonstration, and development leases last February, Salazar issued a new oil shale leasing program that decreases lease acreage by 87 percent, demands unrealistic timelines for investment into cutting edge research, and leaves royalty rates at the whim of the Secretary or in new regulations.

The truth is this: The Obama Administration is so bent on green energy that they haven't even acknowledged the need for oil.

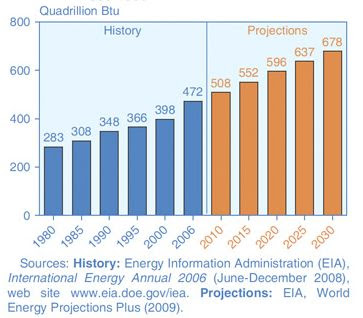

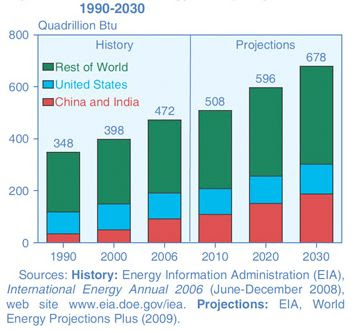

Despite the highest estimates for windmills and sun-power, the wildly held view is that oil will continue to account for 40% of global energy demand 25 years from now... And this at time when energy demand as a whole is expected to increase 60% or more!

Futhermore, all serious research suggests that hydrocarbon-based fossil fuels (oil plus coal, natgas, etc.) will still account for 85% of world energy demand in 2035.

That's why the top tier Chinese oil companies CNPC, Sinopec, and CNOOC have worked with their government bank and made hundreds of billions of dollars of oil and gas investments.

The Chinese Love Their Oil Companies

The popular mood toward oil companies in the U.S. and China couldn't be more different. In China, they have the full support of the government and people.

In the U.S. the big American oil companies like ExxonMobil, ConocoPhillips, and Chevron are dragged before Congress and scapegoated. You may remember your representatives on their high horse back in 2008.

Sen. Dick Durbin (D-Ill.) said, "You have to sense what you guys are doing to us," and called the oil companies "unconscionable."

Rep. Edward Markey (D-Mass.), chairman of the Select Committee on Energy Independence and Global Warming said, "On April Fool's Day, the biggest joke of all is being played on American families by big oil."

The naive sheeple and politicians in the U.S. routinely vilify the very people who supply the energy they use every day. They curse Big Oil as they fill up their Expeditions. Exxon, they claim, is Beelzebub.

If you think oil is expensive now... just wait until we can't get anymore of it.

Giving Away the Store

The cold, hard reality of it all is this: oil is power.

And right now, America and the West are handing over — uncontested — the largest power in the history of the world to their chief rival.

As an investor, I see the future. If the short-term dollar bounce means that oil falls to $70, or $60 or even $55 — I'm a buyer, not a seller. For the simple reason that the Chinese will provide a hard floor and ensure prices. And with the world coming out of recession, there is plenty of upside.

Make China Pay

The good news is that I know where China is going next... and how you can make them pay in what I confidently proclaim will be the best investment opportunity of the decade.

Don't believe me? Read this free report.

All the Best,

Christian DeHaemer

Editor, Wealth Daily

Founder and Editor, Crisis & Opportunity

No comments:

Post a Comment